If you have not fully used your concessional cap in a prior financial year, you may be eligible to use these unused carried forward amounts in a later year.

Depending on your circumstances, this could help you to maximise tax-effective super contributions and invest more for retirement.

How does the strategy work?

If your concessional contributions (CCs) in a financial year are below the annual CC cap, you’re able to accrue these unused amounts and carry them forward. This applies to unused cap amounts since 1 July 2018 and can be carried forward for up to five years. This means if you meet certain eligibility rules, you’ll be able to make larger CCs in a later financial year.

This may give you greater flexibility to make larger CCs when your circumstances allow. This may be helpful if, for example, you have irregular employment income, fluctuating income or have had time out of the workforce.

What’s the benefit?

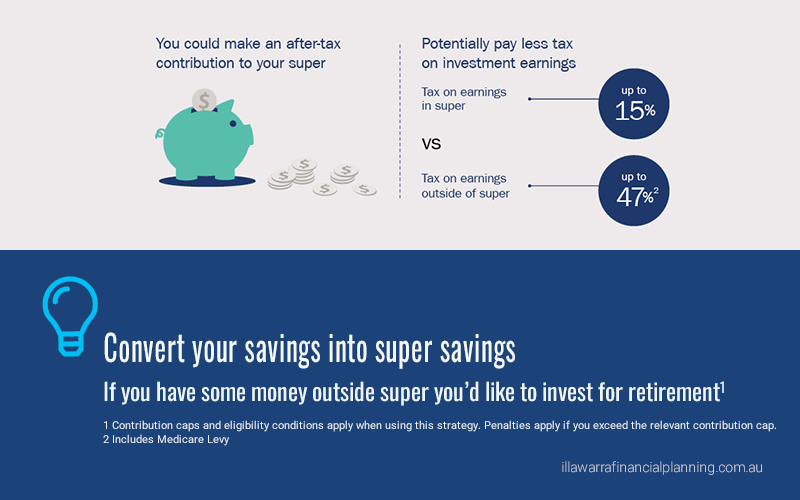

The amount you contribute is generally taxed at the concessional rate of up to 15%1. Once contributed, any earnings are also taxed at a concessional rate of 15%, rather than your marginal rate, which could be up to 47%2. Depending on your circumstances, this strategy could result in a tax saving of up to 32% and enable you to increase your super savings.

Key conditions

To be eligible to utilise your carried forward unused CCs by making a catch-up contribution you must:

- have a ‘total superannuation balance’3 below $500,000 on the prior 30 June

- be under 75 and meet the work test rules (or be eligible to apply the work test exemption) if you’re aged 67 to 74, and

- have unused CC cap amounts accrued from one of the five prior financial years (but not before 2018/19).

Accruing unused CC cap amounts

The first financial year you could accrue unused CCs was in 2018/19. Unused CC amounts can be carried forward for up to five years before they expire.

Seek advice

Your financial adviser can help determine whether this strategy is right for you. They can also help you to work out what your available carried forward unused CC balance4 is and how much you’re eligible to contribute. Additional tax and other penalties may apply if you make contributions that exceed your available cap.

To work out your carried forward amounts, you need to confirm the total amount of CCs you have made in each financial year since 1 July 2018. You can access information about your contributions by logging on to my.gov.au. Information displayed might not be up to date, so it is also important to keep accurate contributions records and enquire directly to your super fund before contributing.

Case Study

In 2018/19 and 2019/20, Fatima made CCs of $15,000, which was $10,000 less than the annual CC cap of $25,000.

Fatima took 12 months maternity leave from 1 July 2020 and didn’t make any CCs in FY 2020/21.

From 1 July 2021, Fatima returns to full-time work where her employer contributions (CCs) total $15,000 in 2021/22. This is $12,500 less than the annual cap that applies in this financial year ($27,500).

Fatima receives an inheritance of $35,000 in 2021/22 that she wants to contribute to super. The table below shows how she can carry forward unused CCs to make catch up contributions in 2021/22 in later years.

Financial year |

Annual CC cap amount |

Total CC cap including any carried forward CCs |

CCs made |

Unused CCs that may be carried forward |

|---|---|---|---|---|

| 2018/19 | $25,000 | $25,000 | $15,000 | $10,000 |

| 2019/20 | $25,000 | $35,000 | $15,000 | $20,000 |

| 2020/21 | $25,000 | $45,000 | $0 | $45,000 |

| 2021/22 | $27,500 | $72,500 | $50,000 | $22,500 |

Other key considerations

- It’s important to check your total CCs for the financial year from all sources before adjusting your contribution strategy. CCs include:

- contributions made for you by your employer as well as an estimate of any further employer contributions for the year

- salary sacrifice contributions, and

- personal contributions that you claim a tax deduction for.

- For personal deductible contributions, you need to lodge a ‘Notice of Intent’ form and receive an acknowledgement from the superfund before certain timeframes, and alsobefore starting a pension, withdrawal or rollover.

- If you are not eligible to make catch-up CCs, tax penalties apply if you exceed the annual CC cap of $27,500 in FY 2021/22.

- You can’t access super until you meet certain conditions.

Do you have the best possible super strategies in place?

Arrange a meeting to speak with one of our experienced Retirement Planning Advisors, either book a virtual meeting or call us to arrange an appointment on 02 4229 8533.

1 Individuals with income from certain sources above $250,000 in FY 2021/22 will pay an additional 15% tax on salary sacrifice, personal deductible and other CCs within your cap.

2 Includes Medicare levy.

3 Your ‘total superannuation balance’ includes all of your super accumulation interests and amounts held in superannuation income stream products. For more information, visit ato.gov.au, and check your total super balance by logging into my.gov.au.

4 You can also obtain this information by logging into my.gov.au

General Disclaimer: While every care has been taken in the preparation of this document, Sydney Financial Planning and Charter FP make no representations or warranties as to the accuracy or completeness of any statement in it.This article contains information that is general in nature. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decisions based on this information. Please seek personal financial advice prior to acting on this information.