Don’t put all your eggs in the one basket. Us planners use the word diversification to explain this concept.

Retirement Strategies

General Retirement Strategies

You may have parents who live on their own but because of failing health they need support to help care for themselves or it may be that they cannot look after themselves anymore and need to move to a home that can.

If you have not fully used your concessional cap in a prior financial year, you may be eligible to use these unused carried forward amounts in a later year.

Want to help boost your retirement savings while potentially saving on tax? Here are five smart super strategies to consider before the end of the financial year.

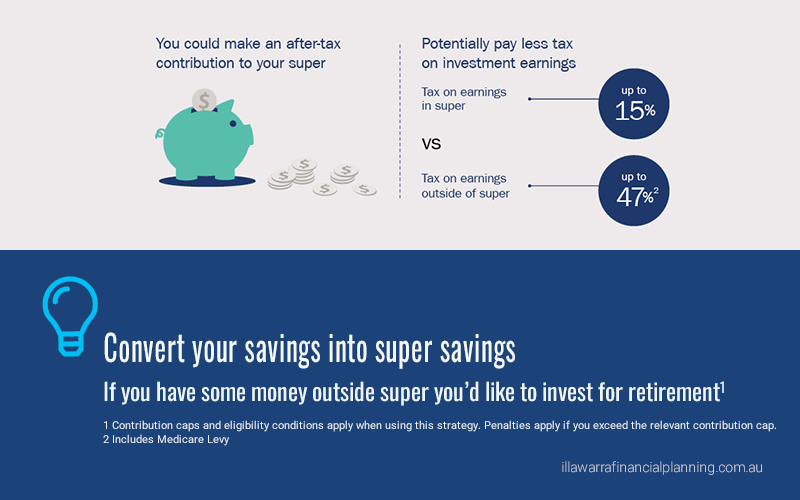

If your income is under a certain threshold, then making personal after-tax super contributions could enable you to qualify for a Government co‑contribution and take advantage of the low tax rate payable in super on investment earnings.

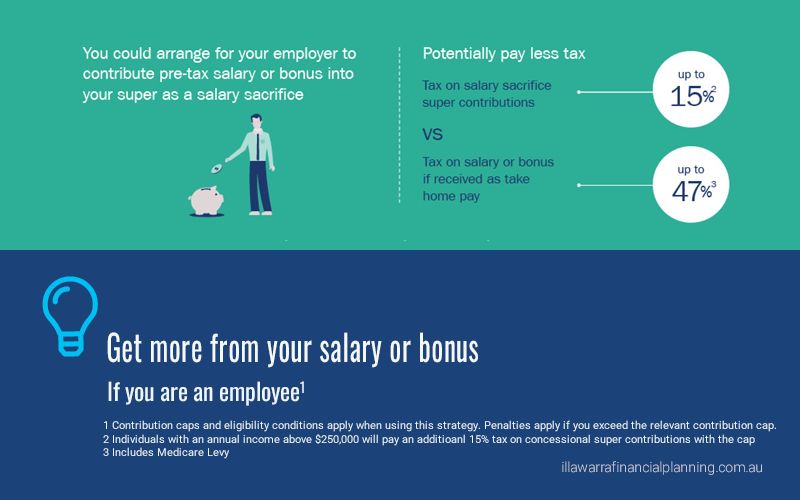

Contributing some of your pre-tax salary, wages or a bonus into super could help you to reduce your tax and invest more for your retirement.

Splitting super contributions to your spouse’s super account may help to boost their retirement savings and provide a range of other benefits.

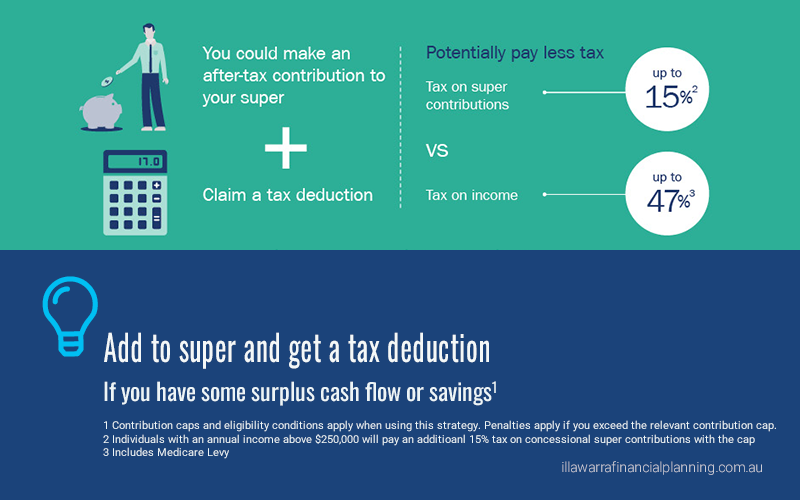

You may be eligible to claim a tax deduction if you make a personal contribution to superannuation. There are some important steps you need to follow carefully and specific timeframes to take action.